Credit Risk Control Overview

Credit risk is most simply defined as the possibility that a client, or counterparty, will fail to meet its obligations in accordance with agreed terms.

Default is the failure to repay or meet existing obligations.

For most banks, loans are the biggest and most obvious source of credit risk; however, other sources of credit risk exist throughout the activities of a bank, including in the banking book and in the trading book, and both on and off the balance sheet.

As such there is a need to ensure that the credit risk undertaken on by the bank is kept in check so that the bank do not put itself at risk of being on the wrong side of the fence.

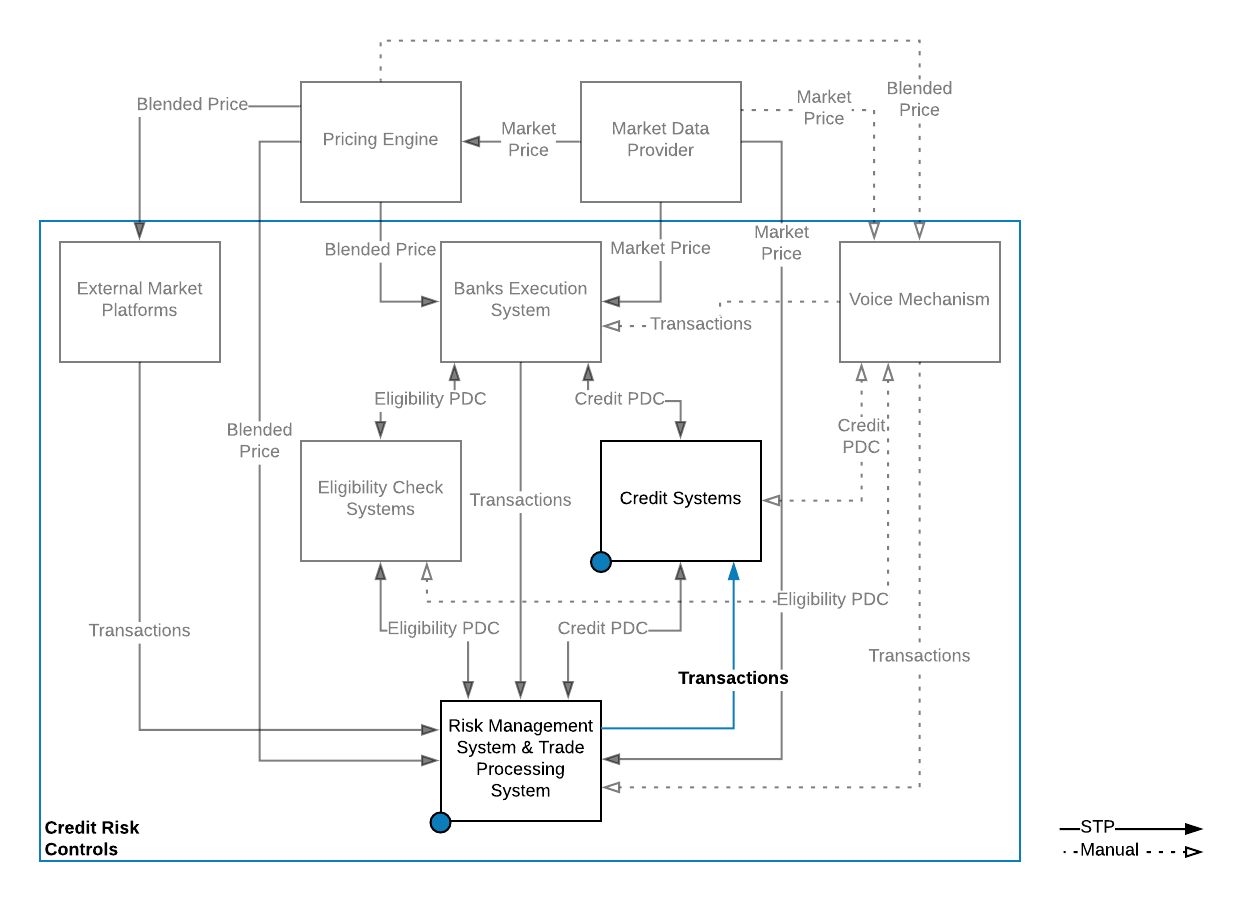

Process Flow

Credit Risk Control

Credit Risk Control in the big picture

Impacts of Credit Risk Control

Issue in the Credit Risk Control space would lead to below potential issues.

- Increase chance of facing default risk if trades are done with counterparty beyond assigned credit limit

- Incorrect utilization leading to loss of business opportunities

- Trading beyong acceptable risk limits

People

This is a process owned by credit risk team

Systems

Credit risk control often takes place either in a standalone credit system. However at times depending on the size of the location and bank, the control might take place in the trade processing system itself.