Confirmations Overview

This is the process by which both economic and general terms of the trade are independently verified with the counterparty. It is a bilateral process which is achieved by providing transaction information to the counterparty and receiving transaction information from the counterparty. Confirmation is a legal document that binds both parties to the deal.

Confirmation contains both economic and general terms of the trade, settlement events (where applicable, for instance, option exercise date stated in the confirmation of option trade) and settlement instruction.

Trade confirmations are issued to counterparty /client on trade date once the transactions have been executed by front office (and successfully validated by middle office in some cases). It’s a key pre-settlement control tool enabling independent validation and confirmation of trade economic details, terms and conditions by both parties to the transaction.

The potential for fraud or unauthorized trading is substantially reduced by independent, timely and accurate transaction confirmation.

Importance of confirmation

- An important risk management process. As confirmation ensures the accuracy, integrity and completeness of all trades captured in the front office system, it helps to reduce booking error which in turn help in reducing market risk (incorrect trade details), counterparty credit risk (incorrect counterparty name), settlement risk (incorrect settlement amount and account and value date), liquidity risk (incorrect maturity date) and legal risk (incorrect terms and conditions).

- Minimise dispute between parties Confirmations serve to ensure that the potential for dispute between the parties at a later point in time is minimized and to protect both parties from financial loss through errors or misunderstanding in the execution of a transaction.

- Protect both parties from financial loss Through confirmation, errors in trade execution or trade capture can be detected timely and this will help both parties to avoid any financial loss due to incorrect trade.

- Discover missing trade Trader has executed trade with counterparty but forget to capture such trade in any system. Once bank receives confirmation from counterparty but cannot find own trade to match. This will then lead to the discovery of missing trade not captured by trader.

- Prevent fraud and unauthorized trading Once confirmation is done on a timely basis and follow up on unmatched confirmations are done promptly, this leaves very little chance for traders to commit any fraud or unauthorized trading.

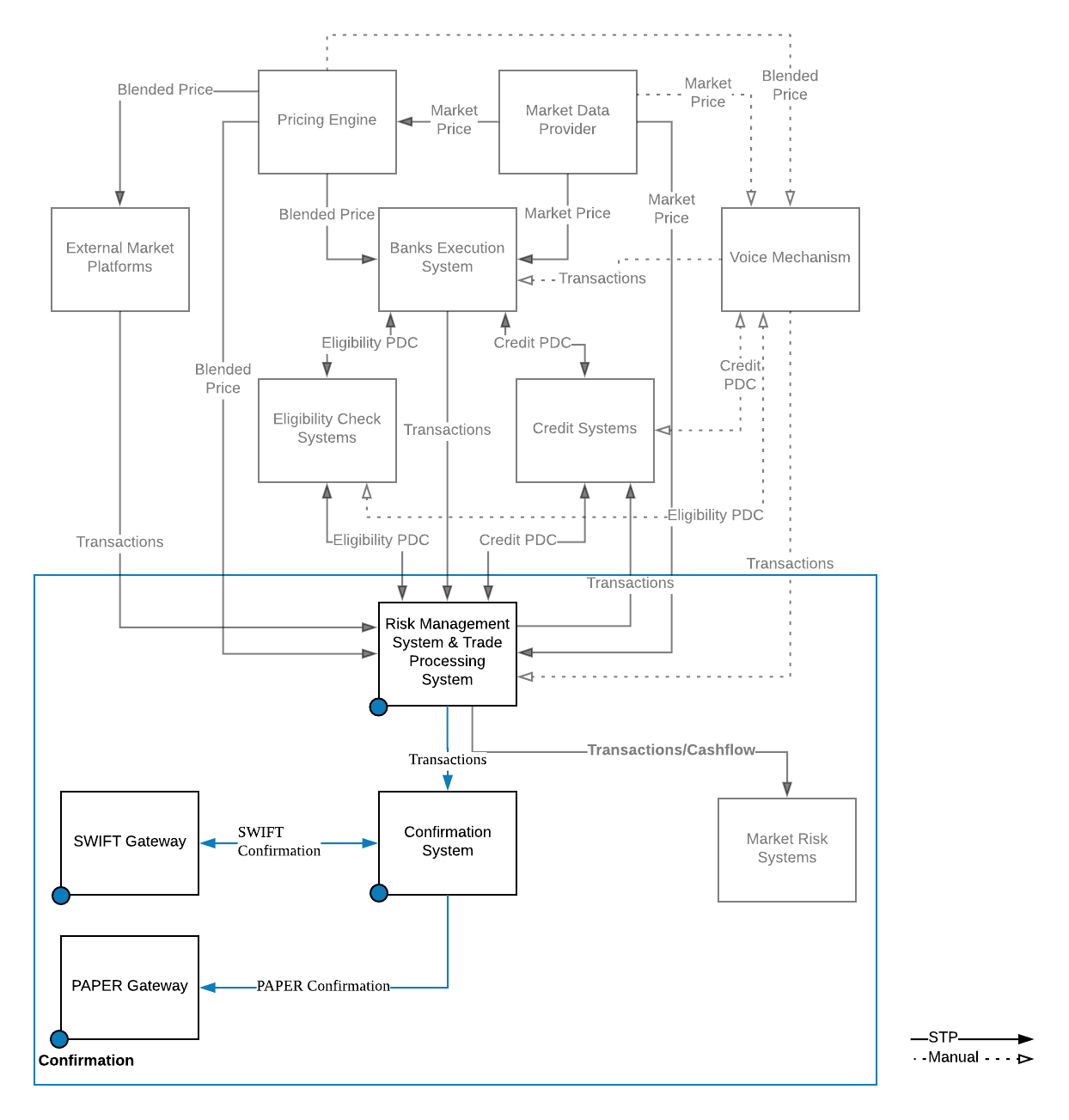

Process Flow

Confirmation flow

Confirmation in the big picture

People

This is a process owned by the confirmation team

Systems

Confirmations functionality can often be found in trades processing systems however there are many organizations that create systems specifically just to handle confirmations. It is very common that confirmations are processed in many different systems given the differences in confirmation requirements and complexities for different product and asset class.

SWIFT and PAPER gateways are essentially the entry point to the external network from the bank which is essential for confirmations.