Market Risk Control Overview

Market risk refers to the risk an institution faces resulting from movements in market prices. In particular, changes in interest rates, foreign exchange rates, and equity and commodity prices. A financial institution’s market risk management department is responsible for measuring, monitoring and reporting the market risk exposure of the firm. It’s key responsibilities are:

- Analyse and quantify market risk

- Develop a strategy to manage market risk including setting risk appetite

- Monitoring the firm’s market risk against risk appetite to ensure alignment with overall corporate strategy.

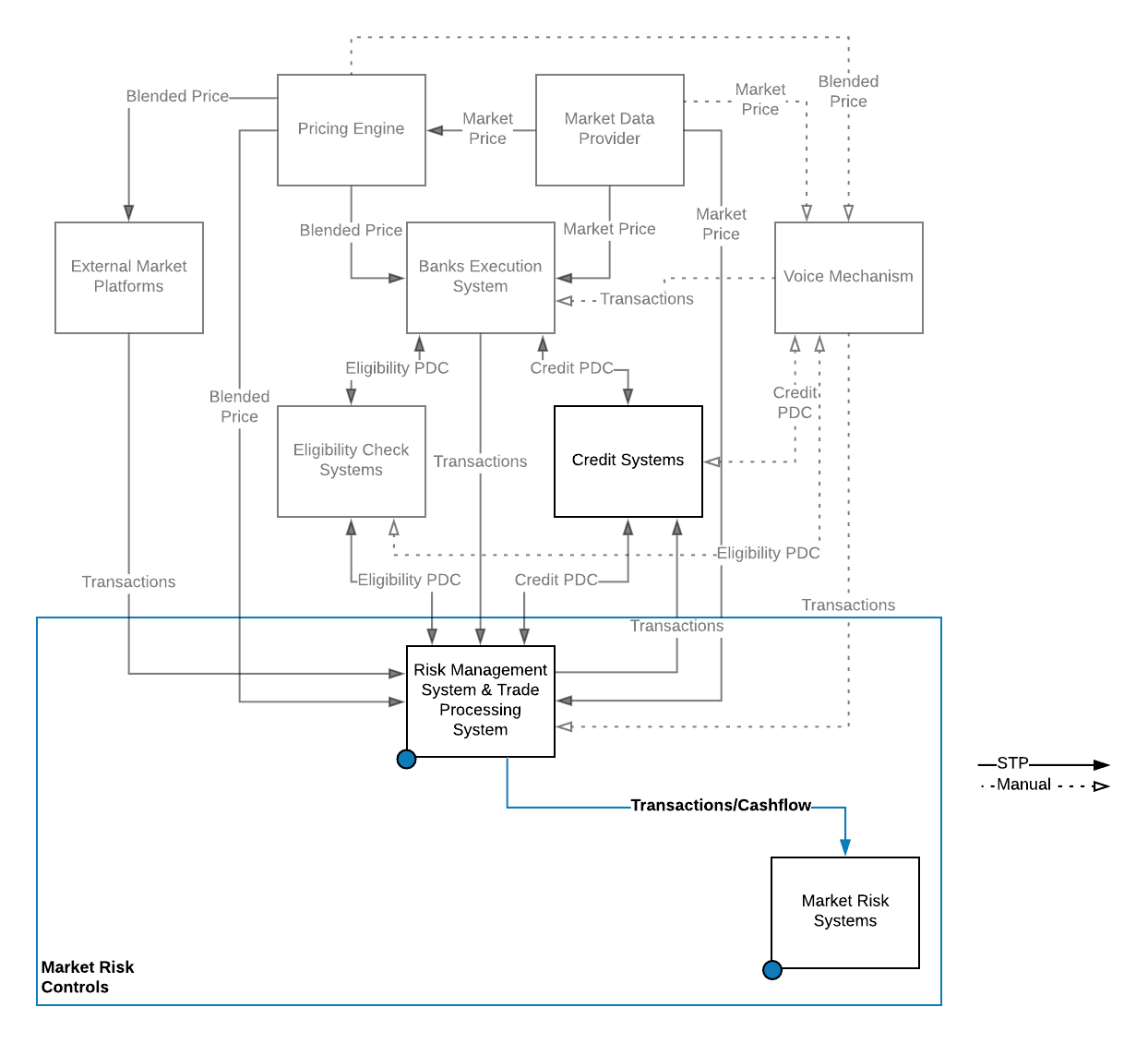

Process Flow

Market Risk Control

Market Risk Control in the big picture

Impacts of Market Risk Control

Issue in the Market Risk Control space would lead to below potential issues.

- Increase chance of facing adverse P&L impact if positions are held above a certain risk limits

- Going in opposite direction of the risk strategy that the bank might have employ globally by taking on position against the plan

- Breach of regulatory limits imposed on the bank

People

This is a process owned by market risk team

Systems

Market risk control often takes place either in a standalone market risk system. However at times depending on the size of the location and bank, the control might take place in the trade processing system itself.