Settlements Processes Overview

This is the process of paying or receiving payment or delivery of securities to and fro your counterparty based on the transacted trades. Settlements are performed on value date of the trade.

There are different ways payment is done and this is largely driven by the type of payment and the type of the settlement instructions defined by the client.

The actual notional to settle with clients are also largely driven by the type of trade booked, market movements and the settlement agreement between the bank and the counterparty.

Any failure in the settlement processes exposes the banks to financial risk and penalties, as such this is one area where controls and checks are of the utmost importance. Depending on banks, there are rules put in place where settlements will not take place till confirmation have been matched. This largely reduce the financial risk of the bank however results in potential slowdown of the end to end process, if the confirmation process is not effective, it will lead to scenario where confirmation matching becomes the bottleneck due to the banks own inefficiency resulting in the banks failure to meet settlement obligations.

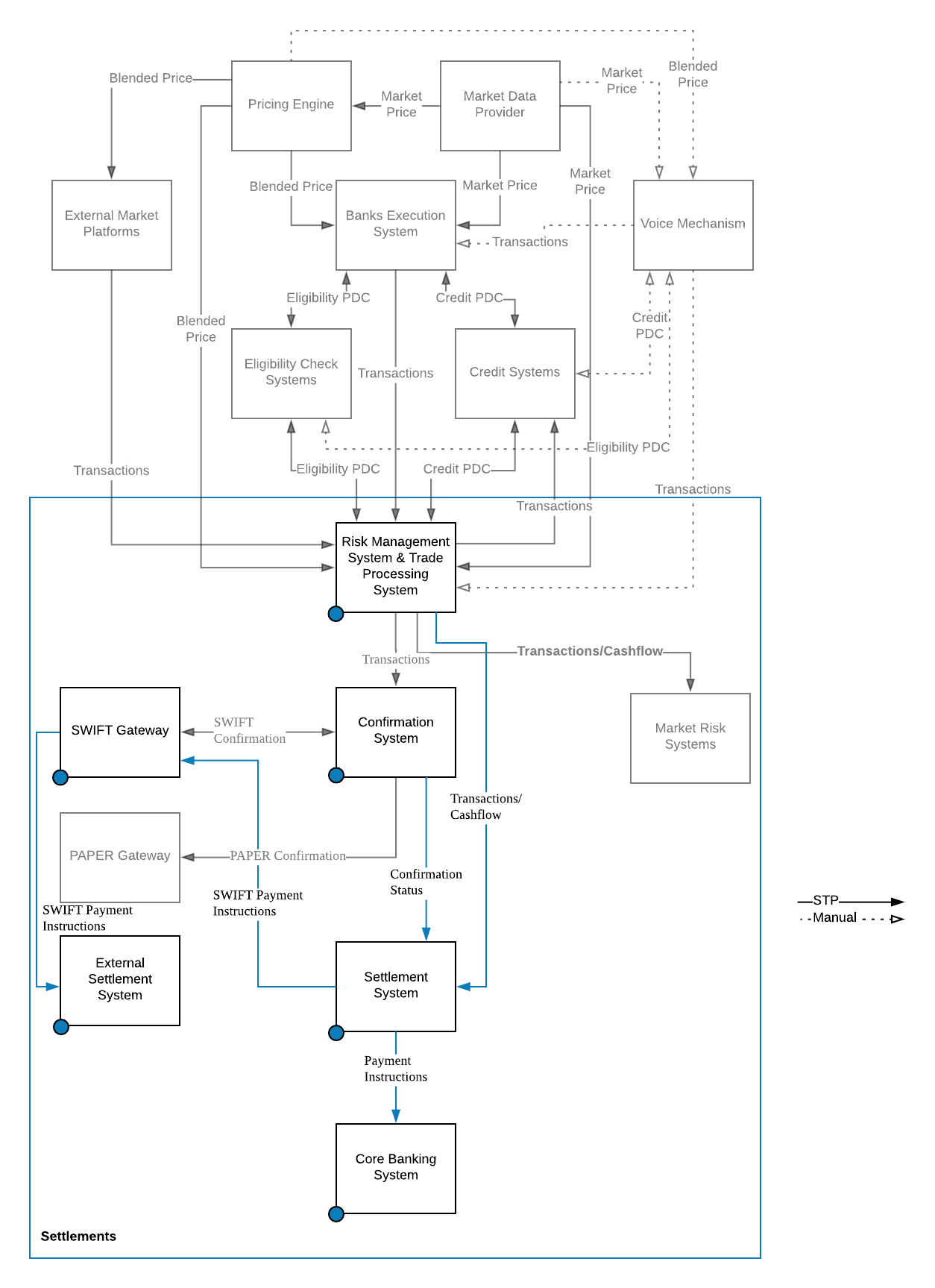

Process Flow

Settlement flow

Settlements in the big picture

People

This is a process owned by the settlement team in operations

Systems

Settlements functionality can often be found in trades processing systems however there are many organizations that create systems specifically just to handle settlements. It is very common that confirmations are processed in many different systems given the differences in settlement requirements and complexities for different product and asset class.

The process of settling cash, securities and exchange traded derivatives are dissimilar and thus there is a tendency for settlement system to deal with each type of settlement separately.

And just like confirmation that uses SWIFT, it is the industry standard to also use SWIFT for settlements.

In the market, there are also organization that facilitate settlement services such as RTGS provided by central banks and clearing houses provided by central bodies such as LCH and CLS. This central services have their own systems which the bank will need to connect to, such as to facilitate settlement thru these services.